PrEPARING Your Home

Floods are among the most destructive natural disasters in the U.S., causing billions in property damage every year. Even minor flooding can ruin flooring, walls, furniture, and electrical systems within minutes. Whether you live near a river, the coast, or in an area with heavy rainfall, preparing your home and ensuring you have the right insurance coverage before disaster strikes is critical to protecting your family and your home.

🏡 1. Elevate Electrical & HVAC Systems

Test sump pump and generator and raise outlets, switches, and major appliances above the base flood elevation to minimize damage during floods.

👉 Shop: Outlet Covers | Raised Utility Platforms

🚪 3. Seal Foundation Cracks & Install A SUMP PUMP

Use hydraulic cement or foundation sealants to close small cracks and install a sump pump to mitigate water incursion.

👉 Shop: Basement Sealant | Backup Sump Pump

🌧 2. Install Flood Barriers or Sandbag Alternatives

Reusable flood barriers and water-activated sandbags can redirect water away from entry points like doors and garages.

👉 Shop: Quick Dam Flood Barriers | Door Flood Shields

🌿 4. Improve Yard Drainage

Grade your yard away from the foundation and use rain barrels or French drains to manage runoff naturally.

👉 Shop: Rain Barrel Kit | French Drain Kit

Insurance Coverage That PROTECTS YOUR PROPERTY AND YOUR INVESTMENTS

💧 Flood Insurance

Offered through the National Flood Insurance Program (NFIP) or private carriers, flood insurance covers damage from rising water, storm surges, and overflow from nearby bodies of water. It’s essential for anyone in a flood-prone area and often required for federally backed mortgages.

🏠 Homeowners Insurance

Standard homeowners policies often exclude flood damage caused by rising water, so it’s important to understand what’s covered—and what’s not. They typically protect against wind, fire, and theft, but not water entering from outside sources. Review your policy’s exclusions to ensure you’re not left exposed.

🚗 Auto & Living Expense Coverage

Comprehensive auto coverage protects your vehicle from flood-related damage. Additionally, Loss of Use or Additional Living Expense coverage pays for temporary housing and daily needs if your home becomes uninhabitable after a flood.

WhY REVIEWING YOUR POLICY NOW MATTERS

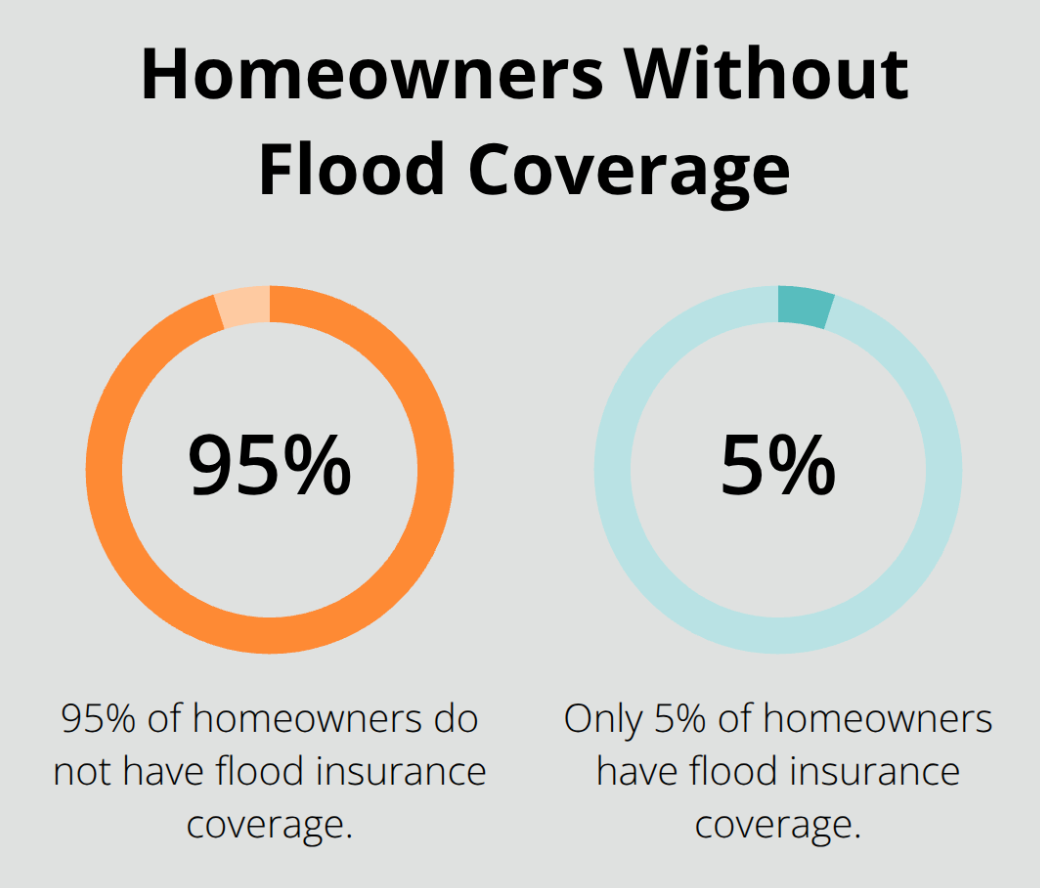

Flooding events are growing more frequent and severe, leading some major insurance providers to withdraw from high-risk areas or raise premiums dramatically. At the same time, The National Association of Insurance Commissioners (NAIC) estimates that up to 95% of homeowners don’t have adequate flood insurance. If you live near water or in a region prone to flash floods, it’s vital to review your coverage today and compare rates among private and National Flood Insurance Protection (NFIP) options to ensure you’re adequately protected.

FIND COVERAGE OPTIONS IN YOUR AREA

Flood risk is changing—even in areas that have never flooded before. Now is the time to make sure your coverage, property, and emergency plan are ready for the next storm.

Don’t wait until it’s too late—protect your home and your family today.